Status of digitalization in stationary retail using the example of Ku’damm & Tauentzienstraße

Shopping around Berlin’s Tauentzienstraße and Kurfürstendamm

Tauentzienstraße and Kurfürstendamm are among the most frequented shopping streets in Germany, and their appeal is not diminishing even in the age of online retail. Nevertheless, the stores on these streets have to face the changing customer expectations and the challenges of digitalization. In a recent study by eStrategy Consulting, 165 stores along these two streets were examined. The focus was on linking the local business with digital marketing and sales channels as well as digitally supported processes in the local business itself. The study defines three phases along a typical customer journey: 1. digital visibility of stores and product ranges, 2. digital customer experience in the local store, 3. digital customer loyalty and after-sales services. A total of around 45 factors for digitally driven services and the digital point of sale (POS) are recorded and assigned to the three phases and weighted according to their importance. This is ultimately used to calculate an index for digital maturity in each phase, with scores ranging from 0 (not mature) to 10 (very mature). The result shows a great need for action, which is also confirmed by a comparison with empirical studies on customer expectations.

Focus areas of the study along the customer journey

Digital visibility of stores and product ranges

Almost all stores along Kudamm and Tauentzien are registered on Google Maps and achieve visibility for their physical presence there, including opening hours and contact details. However, barely over half of the stores (53%) offer their own website for the local store. Significantly fewer stores offer customers visibility of the local product range (39%). These include the general display of local availability (39%), Click&Collect (33%), ship-to-store (32%) or in-store returns (30%). Less widespread are courier pickup (15%) and Click&Reserve (13%). The aim of all these functionalities is to create visibility for the local product range in times of online retail and to generate customer frequency and sales for the local business. A total of 10 factors were analyzed and weighted, which are particularly relevant for the customer in this phase of the customer journey.

Average digital maturity

The average digital maturity index is at 5.5 out of 10 points. When looking at the digital maturity per product group, the index varies from 4.0 to 6.7. This wide range illustrates considerable differences between the product ranges. Retail chains such as Rossmann and dm (FMCG) as well as Conrad and Saturn (CE) achieve a high level of visibility and a comprehensive omnichannel presence. The largest group is made up of fashion stores (68% of stores), which exhibit a high variance and only average digital maturity overall. Pharmacies, opticians and medical supply stores are among those in the miscellaneous segment, which lag far behind in this index.

Digital costumer experience in the local store

In the second step, the study looks at the digital customer experience in local stores. To this end, all 165 stores were examined and the digital maturity of the POS was assessed based on 50 criteria, which can be arranged in six dimensions: 1. inspiration (e.g. digital displays with image or video advertising), 2. entertainment (e.g. interactive displays with gaming elements), 3. Information (e.g. interactive displays or tablets for product or store information), 4. advice (e.g. product experience via AR/VR or product configurators), 5. payment (e.g. contactless payment via Google Pay, Apple Pay or Alipay), 6. services (e.g. home delivery or free WiFi). The possibilities for enriching the customer experience through digital technologies are basically endless and the structure introduced here is just one of many possibilities.

Digital maturity of the POS

Across the board, stores show only a low level of maturity with regard to the digital POS. On average, the digital maturity index is just under 2.5 (out of 10). However, the electronics retailers are well above the average with 5.7 points. At Saturn and Conrad, customers can not only obtain a wide range of information and services via digital displays, but these are also omnipresent in the stores. They are followed at a considerable distance by furniture and fashion stores, which rely primarily on inspiration via large displays. Even large stores such as KaDeWe do not offer customers any digital support in terms of product range information or navigation.

Digital costumer loyalty and after-sales services

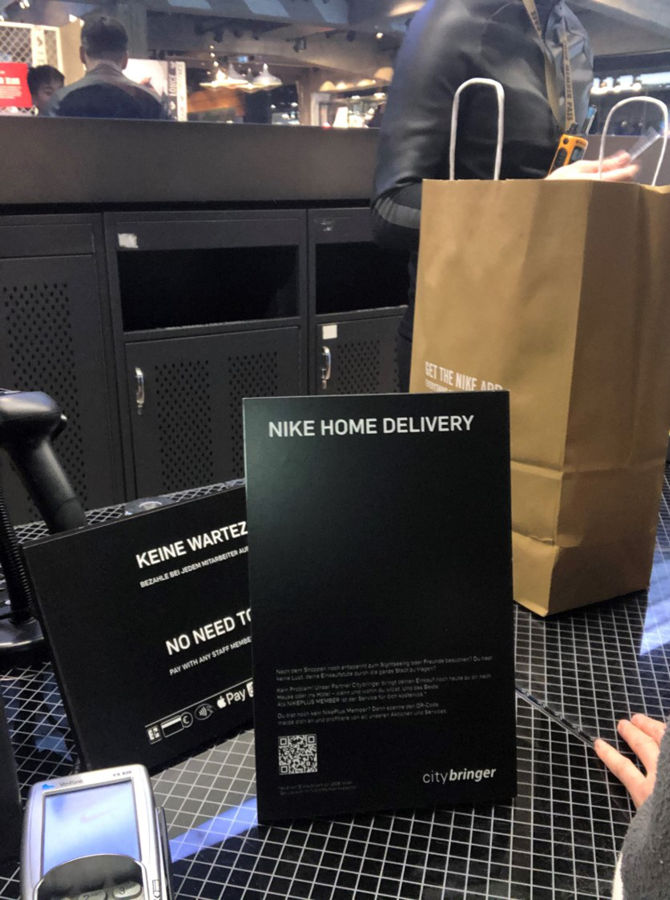

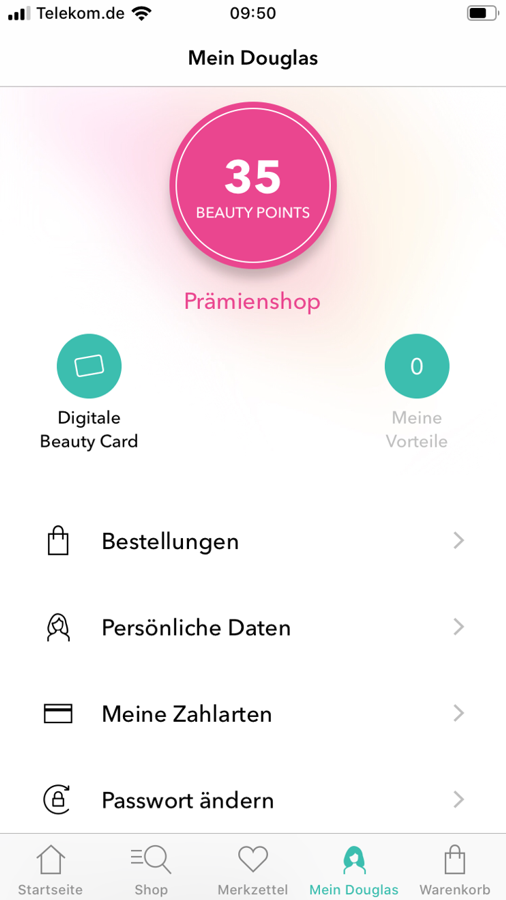

The final phase of the customer journey is characterized by after-sales services and loyalty programs. After-sales services include free home or hotel delivery and the option to return items purchased online to the store. Customer loyalty includes active reference to customer cards and clubs, access to apps via QR codes and active customer registration for newsletters. Basically, the retailer’s aim in this phase is to achieve the highest possible customer lifetime value.

Digital maturity in after-sales

The average digital maturity index across all stores is 3.1 (out of 10). In this phase of the customer journey, stores for home furnishings (4.3) and cosmetics and drugstores (4.2) are ahead. The large group of fashion stores scored below average in terms of customer loyalty and after-sales service.

Highlights of the analysis

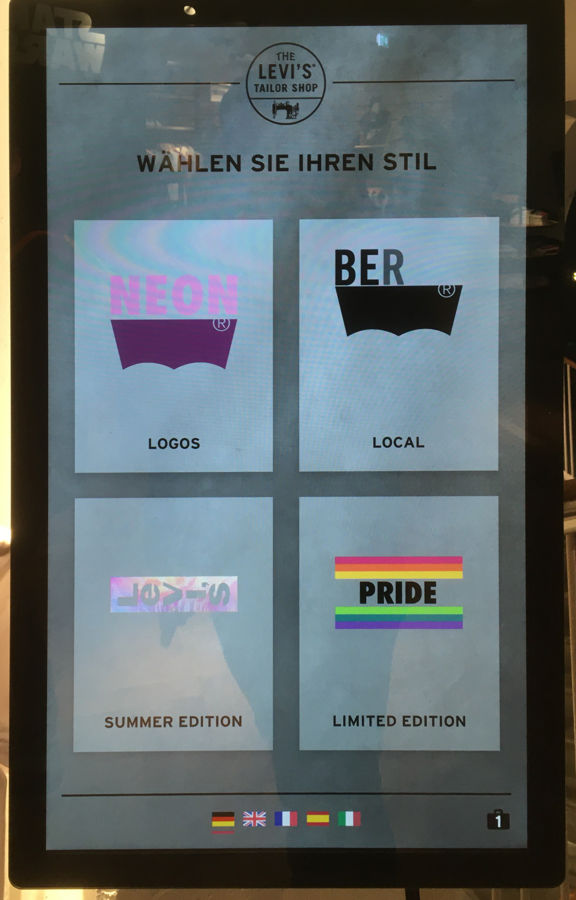

The following section presents some special solutions that were viewed as part of the analysis but could not be sufficiently emphasized in the given evaluation scheme. Conrad Electronic, for example, operates a 24-hour kiosk that can be opened with a debit card and where customers are served a small, predefined product range by a robot. Saturn provides a cell phone vending machine that accepts customers’ used smartphones and issues vouchers in return.

O2 operates a concept store that can be used for customer service, training or events, among other things. Lego offers a range of interactive technological entertainment applications for children. Adidas and Nike focus on customer performance, including functional clothing and apps for self-optimization, in rather minimalist sales areas. In line with this, the sales assistants are also supported by technology, including radios and tablets. At Nike, for example, customers can pay any sales assistant in the store and avoid queuing at the checkout. The sales staff at Marc O’Polo, which stands out in the fashion segment, are similarly equipped and use tablets to convert customers into newsletter recipients, for example, or provide information on available product ranges.

Comparison to costumer expectations

This study did not survey customers on their general expectations or their feedback on the retailers’ existing offerings. Suitable third-party studies that have recorded customer expectations in a compatible methodological setup are hard to find. An AYDEN study from 2018, for example, asked customers what is important to them when shopping in bricks-and-mortar stores. Many results relate to factors that are not digitally driven, such as parking spaces. All digitally driven factors were compared with the characteristics of retailers on Ku’damm and Tauentzien in the following graphic.

The graphic shows that customers expect more digitally driven services and experiences in-store. The customer desire for a digital receipt, smart mirrors and an AR/VR experience for a virtual product experience or additional information is currently not being met at all.

Regarding omnichannel services, almost 80% of customers would like information on the availability of the local product range, which is already provided by 40% of stores on Ku’damm and Tauentzien currently. Other omnichannel services requested by customers, such as Click&Collect or in-store returns, are already offered by many stores. The topic of mobile payment was only mentioned by a few customers but is currently being implemented across the board in local retail.

Kurzportrait & Kontakt – eStrategy Consulting

eStrategy Consulting hilft Klienten dabei, digitale Innovationen zur Weiterentwicklung bestehender Geschäftsmodelle und für den Aufbau neuer Geschäftschancen zu nutzen. Die Handelsbranche unterstützen wir dabei in der Weiterentwicklung zum Omnichannel und Connected Commerce und zählen Hersteller, klassische Big Box Retailer, die Handelsimmobilienwirtschaft oder digitale Marktplätze und Plattformen zu unseren Kunden.

eStrategy Consulting deckt den gesamten Lebenszyklus digitaler Innovation ab, von der Analyse über die Ideation, die Lösungsentwicklung und die Markteinführung. Wir arbeiten als Strategie- und Konzeptentwickler sowie als nahtlos integrierter und pragmatischer Umsetzungsmanager. Wir setzen dafür auf einen Methoden-Mix aus der Welt des Digital Business und der klassischen Unternehmensberatung. Im Mittelpunkt stehen dabei sowohl die anwendenden Kunden unserer Klienten als auch seine Organisation und Fähigkeiten, die zum Betreiben notwendig sind.